From David Lorentz

Chief Research Officer

National Golf Foundation

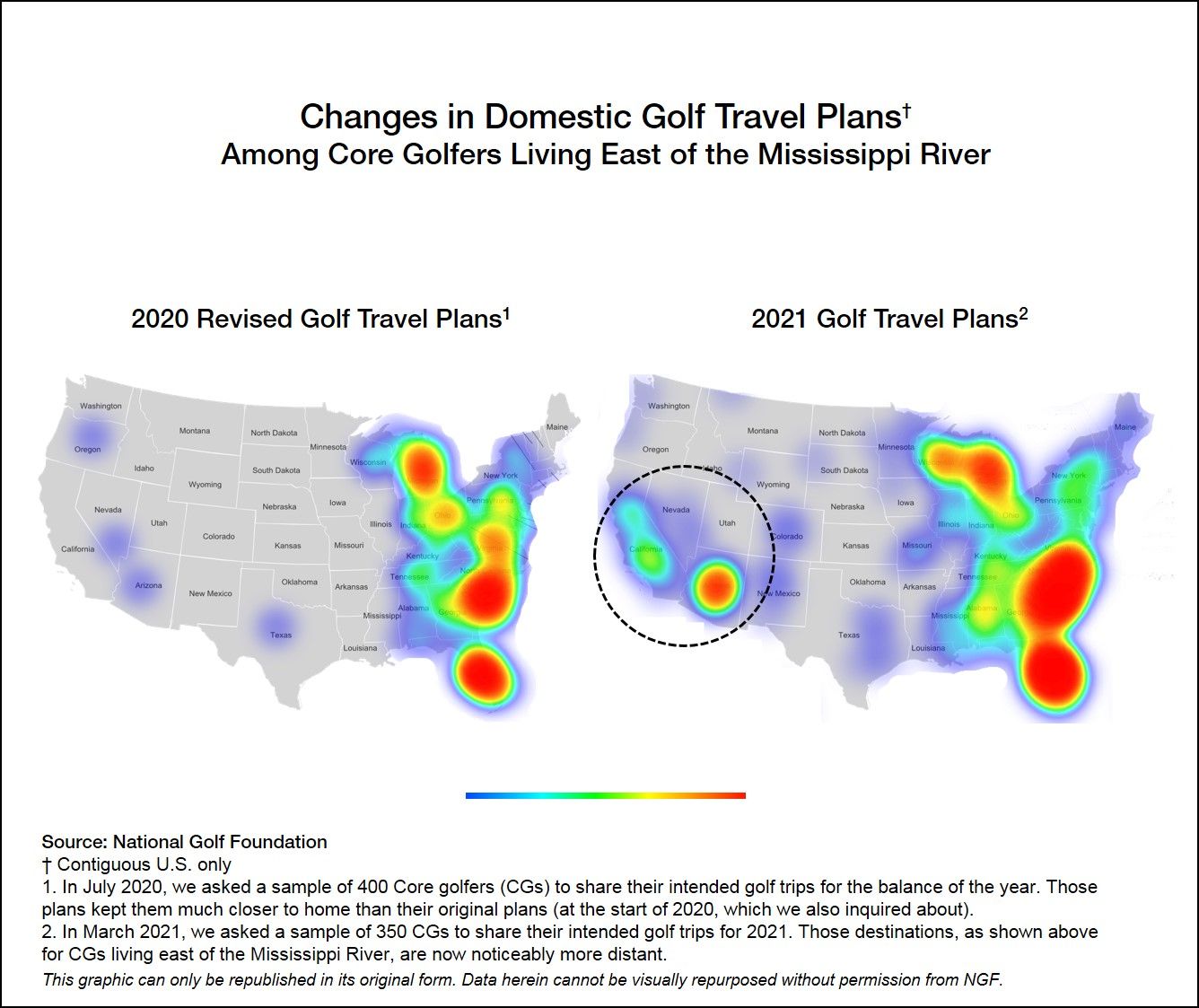

Editors’ Note: The National Golf Foundation surveyed golfers to see if their travel plans for making long trips have changed since last year. Here is an overview of their findings in late April.

The comeback of commercial aviation is underway in the U.S., which no doubt bodes well for many in the golf business. Despite an increased willingness to trundle down the open highways last year, golfers made far fewer trips in 2020 (at least 50% fewer, we now estimate), which impacted resorts and businesses – far and wide – that cater to the needs of travelers.

Passenger throughput at domestic airports currently sits at 57% of 2019 levels (using 7-day rolling data). This is up from 45% at the beginning of March and 37% at the beginning of February. The trend is expected to continue alongside the increasing incidence of vaccinations, and the rolling back of pandemic restrictions. At the moment, it seems the rebounding is especially evident at smaller, outdoor-vacation-oriented airports vs. big-city hubs[1] – suggestive of a “get away but stay safe” mentality that will likely permeate for some time, and should benefit many golf properties.

This return to the friendly skies means more golf trips and more destinations back in the consideration set. Core golfers, on average, are now expecting 1.8 golf trips in 2021, which rivals reported counts in recent, non-pandemic years. As for where, the ones who’ve already taken a golf trip in 2021 ventured 40% farther, on average, than golf travelers did last year (600 miles vs. 425, as the crow flies), while trips planned for the rest of the year should be almost as distant (590 miles, on average).

These are positive and perhaps expected signals from golfers, which we’ve corroborated through discussions and surveys with operators. Based on responses from four dozen resort properties, nearly three-quarters indicated pre-bookings for May-December are higher than last year, and almost two-thirds suggested they’re higher than other recent, non-pandemic years. More broadly, 9 of 10 reported increases in rounds, website activity and social media engagement, while 8 in 10 reported increases in travel package inquiries. The lone soft spot, it seems, are the more lucrative large-group and corporate bookings – only 40% mentioned those were up.

Recovery in the travel sector will be welcome news for many, but also means golfers will once again be forced to make certain tradeoffs. Whether for business or leisure, the return to flying will cut into “golf time” and personal discretionary budgets – the extent to which we’ll be looking to understand.

(For more findings and anecdotal feedback from NGF member operators, please click here).