Provided by the National Golf Foundation

The National Golf Foundation (NGF) has the world’s largest research team dedicated solely to the golf industry. They provide accurate data to golf centric businesses to help evaluate trends and consumer preferences. The data also provides interesting insight for golfers in general.

With the debate between LIV, DP World Tour and PGA Tour still making headlines, golf continues to post gains and is getting stronger every day.

Golfers are traveling to more resorts, even though some courses have closed, there are plenty of green-grass facilities across the country, as well as internationally, to satisfy every golfing need. A golfer only needs to be willing to pony up his hard-earned dollars to take a dream golf trip, or play a top-ranked course.

Golfers Continue to Spend Money on Golf Travel

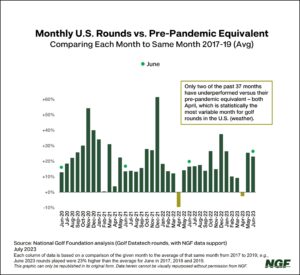

With a 10% increase in rounds played for the month of May, it appears the upswing in golf that began during the COVID pandemic, is still continuing to draw more golfers to the game.

Golf-related travel is the ultimate discretionary expense and clearly demonstrates overall demand. A golf trip requires planning, commitment and, for some, intense negotiating with loved ones. In other words, you’ve got to LOVE golf to make this investment.

It’s encouraging to see that golf continues its positive trend. NGF polled 40 golf resort and destination properties across the United States and reported advance bookings are up 5-7% over 2022. This same group reported that advanced bookings had outpaced 2021 numbers by roughly 12% last year. That is a 19% increase, since the end of COVID with no end in sight.

Additional Data Supporting the Golf’s Growth

More than 70% of Core golfers have, or expect to take, a golf trip before the end of the year.

An indicator that supports this high number, online searches for golf travel bags is running 30% ahead of pre-pandemic.

Golf tourism is the second largest sector and a critical component of the U.S. golf economy.

Over $31 billion was spent in 2022 on golf trips longer than 50 miles from home, including expenditures for travel, lodging, meals and incidentals during the trip.

Golfers spent another $9 billion in green fees, cart costs, range balls and merchandise, as well as food and beverages. All told golf travel including additional expenditure associated with travel had a total impact of $40 billion, which is 40% of the golf industry’s overall economic contribution.

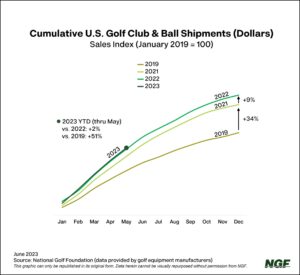

Equipment Sales trending above 2022 record sales numbers.

Golf equipment sales are an obvious measure. If you are going to play you must have the latest and greatest equipment and everyone agrees that golf is a non-essential activity. The money for golf clubs, balls and gloves definitely comes from a family’s discretionary funds. Spending money on golf is not essential, but it sure makes golfers happy.

Golf equipment sales are an obvious measure. If you are going to play you must have the latest and greatest equipment and everyone agrees that golf is a non-essential activity. The money for golf clubs, balls and gloves definitely comes from a family’s discretionary funds. Spending money on golf is not essential, but it sure makes golfers happy.

Cumulatively, ball and club sales are up 2% versus a year ago and still running 51% above pre-pandemic base numbers. While some of that is attributable to pricing increases, a byproduct of demand and rising costs for materials, research & development, shipping and labor, speaks to the sustainability of golf’s post-pandemic lift.

Entering June, golf equipment shipments were down about 4% compared to the same mid-year stretch in 2022, but individually golf balls sales were up almost 18%. Someone is losing a lot of golf balls.

Women’s Numbers Continue to Grow

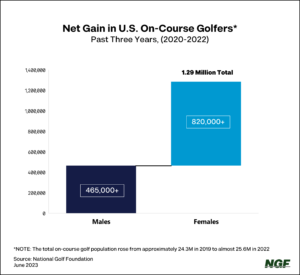

Over the past three years (2020-2022) golf has seen over 1.2 new golfers taking up the game. Of that number 820,000 were women compared to 465,000 men.

One of the most notable aspects of the pandemic-driven rise in participation over the past three years: the influx of women and girls.

- There are about 6.4 million female golfers, up from 5.6 million in 2019.

- The net gain of 800,000+ women golfers is far more than on the men’s side.

- The number of female golfers jumped 15% compared to only a 2% increase among male golfers.

There has never been greater female representation on the golf course than right now, with women and girls accounting for just over one quarter of all golfers.

Local golf courses, private clubs and other junior golf programs are leading the charge. Young girls are taking up the game in record numbers with junior developmental programs focused on young women. Girls now represent 38% of all golfers under the age of 18.

When NGF first started tracking golf participation by gender, in 1986, the proportion of girls was just 14%. A 24% increase in 37 years is quite dramatic.

Topgolf has helped bring people to golf. Their fun, socially focused and less-intimidating atmosphere helps girls get comfortable and gain confidence. Female participation in off-course forms of the game account for just under 50% of all participants.

Greater visibility and support of industry initiatives that make golf more welcoming and inclusive has been vital too. The LPGA Tour unveiled a new line of affordable equipment at Walmart to increase access for female beginners and juniors. And June, which is Women’s Golf Month, kicked off with a Women’s Golf Day global celebration of introduction, promotion, and engagement.

Future growth, however, is dependent on this recent rise among female golfers being sustainable. The golf experience needs to continue to evolve and appeal to the younger generation while not taking away from traditionalists.

There is Still an Adequate Supply of Golf Courses

The United States has, by far, the largest number of golf courses. From Alaska to Florida this country has more courses than the next top 10 nations combined.

The game of golf also has remarkable international geographic spread, with at least one course in 83% of countries and territories recognized by the International Standard Organization.

In total 207 of 249 countries have at least one golf course. That number will increase to 208 later this year with the opening of a new course in Iraq designed by Cynthia Dye, daughter of Pete and Alice.

There are more than 37,600 golf courses worldwide. Course closures are on pace with last year, which ended up with the fewest since 2005 – prior to the Great Recession. New golf course development is slowly ticking upward.

It’s intuitive that as golf enjoys increased participation and engagement, fewer owners and operators are motivated to sell or shutter courses. At the same time, a small number of operators, owners and developers who have been sitting on the sidelines have clearly decided the time is right for a new golf project.

The Bottom Line

Golf is stronger than it has ever been. Participation among women and juniors continues to grow. More courses are being built to meet ongoing demand. Golf equipment manufacturers are seeing increases in sales and profits.

It’s good to be in the golf business right now.

For more statistics and information visit: https://www.ngf.org/.